Pricing model or pricing process - which is right for you?

Steven Forth is a principle at Ibbaka and valueIQ. Connect on LinkedIn

Some companies have pricing models that they use to define prices. Some companies have a pricing process that they use to set prices. Some have both. Some get by without either.

This gives rise to four approaches to pricing, any of which can be appropriate under certain circumstances.

Process and models can be used in different ways. Before we dig into this, let’s start with some simple definitions.

What is a Pricing Model?

A pricing model is a system of equations where inputs generate a price (or, in certain cases, a price range and a set of tradeoffs).

The pricing model can be used in different ways:

The pricing pages that one finds on websites (Ibbaka’s valueIQ Pricing Analyst agent has parsed more than 2,000 pages over the past couple of months)

Price books used by sales teams

Models encoded into other systems

Pricing models are most often found in spreadsheets, but they are increasingly being developed as code-based applications, and they also get coded into CRMs, CPQs, and billing management systems.

Pricing models are designed and best developed and maintained using design thinking approaches. There are ongoing efforts at many companies to use generative AI to generate, explore, test and evolve pricing models, but this is still early days.

What is a Pricing Process?

A pricing process is a set of algorithms and heuristics that generate a price or a pricing model that provides a price.

Algorithm: An algorithm is a precise, step-by-step set of instructions that always produces the correct solution to a problem if followed correctly.

Heuristic: A heuristic is a practical shortcut or rule of thumb used to find solutions quickly, which may not always be exact or optimal.

Most pricing processes rely more on heuristics than algorithms, though that may change as more and more different types of data become available or are synthesized.

Pricing processes come in many flavours.

Some examples …

Customer Segmentation & Elasticity Analysis

Collect customer data on demographics, industry, company size, and willingness to pay.

Run statistical models (e.g., regression, clustering) to segment customers based on these variables.

Apply price elasticity calculations within each segment using historical conversion, churn, and upsell data.

Assign price ranges or recommend pricing models per segment, iteratively updated using new data and model feedback.

Price Optimization Algorithm

Gather real-time data on usage, costs, competitor pricing, and customer behaviour.

Feed this data into a pricing optimization engine (machine learning or rule-based).

Simulate different price points and models (tiered, usage, freemium) using algorithms to forecast revenue, retention, churn, and market share.

Continuously refine prices based on the actual outcomes, automatically updating prices on the platform.

Value Modelling Workflow

Use algorithms to model the business value delivered to each customer based on reported/estimated revenue impact or cost savings.

Parametric algorithms generate a configuration (features + price) that maximizes the value delivered over cost.

The process calculates where Value > Price > Cost, presenting these optimized packages as price recommendations to sales or automated quoting systems.

Poll on Pricing Process and Pricing Models

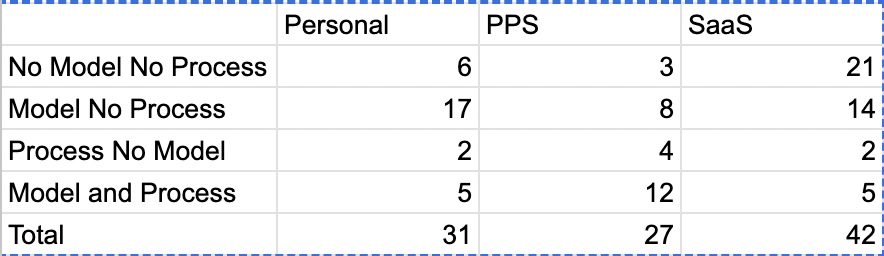

In early November, we polled our communities on the pricing process and pricing models. This poll was shared on Steven Forth’s personal feed, the Processional Pricing Society group and the Software as a Service Group. N = 100.

Overall, only 30% of companies responding used a pricing process, while almost 70% have a pricing model (I am skeptical about this, but, well, self reported data).

LinkedIn poll on pricing models and pricing process from November 6 to 8, 2025

LinkedIn poll on pricing models and pricing process from November 6 to 8, 2025

When we compare pricing professionals and SaaS community members, we see a big difference. Fifty percent of the SaaS community respondents said they have no process and no model. This seems closer to the reality in the field than the 12% reported by people in the Professional Pricing Society group.

The four patterns

Ad-Hoc = No Process and No Model

This is where many companies find themselves. They have prices; without prices, you cannot transact business, but there is no commonly understood way to come up with a price. Pricing lives in the heads of a few senior people, or in some cases, the pricing is a ‘frozen accident,’ it was set at some point in the past, no one quite remembers how or why, and it is now embedded into behaviours and systems. This pricing is seldom optimal, and worse, it is hard to improve.

Disciplined = Process but No Model

Not every business needs a pricing model. Businesses that provide bespoke or highly configured solutions are often better off with a robust pricing process and no pricing model.

A good process is more important than a good model over the long term. Provided there are feedback loops in place to measure the outputs of a process and to improve them, the process provides more leverage than the model.

Right now, the leading companies are investing in AI-enabled pricing processes rather than AI-based pricing models.

Most well-designed pricing processes can be modified to generate pricing models rather than prices when needed.

Static = No Process but Model

Many companies with pricing pages and formal pricing books, or pricing embedded in their systems (CRM, CPQ, billing), have pricing models but no process. In many ways, the pricing models are ‘frozen accidents.’ This is generally a step up from purely ad-hoc pricing. At least people know how prices are set by applying the pricing model. If it is a good pricing model, and through natural selection most of the pricing models are at least adequate, that can be good enough in established, stable markets. But markets are not stable today, so a pricing model with no process to evaluate, improve and reinvent it is a straitjacket.

Adaptive = Process and Model

The end state that most companies should be working towards is a pricing process that:

Generates a pricing model

Has feedback loops for continuous improvement

Can be used to support the pricing of innovation (new features and products)

Can generate more than one type of pricing model (so that pricing model innovation is also a possibility)

Pricing process and pricing model can share many dependencies, but they are different things and need to be designed and managed differently.

Conclusion

B2B SaaS leaders facing GTM, product, marketing, sales, rev ops and pricing decisions must carefully balance the roles of pricing models and pricing processes in their organizations. The era of relying on instinct, legacy, or "frozen accident" pricing is ending; market volatility and innovation demand more adaptive, dynamic approaches.

Relying solely on a pricing model or process is rarely enough; both should evolve in tandem, supported by design thinking, data, and feedback loops for continuous improvement.

Leading companies are shifting toward AI-enabled pricing processes that continuously learn from new data across the customer journey, with adaptive models built in rather than static pricing pages or books.

The optimal path is not static: as products and markets shift, the ability to generate, test, and reinvent pricing models from strong processes will separate SaaS leaders from laggards.

Actions

Evaluate your own practices: Is pricing a legacy artifact, a disciplined process, or a living system of continuous innovation? The tools and thinking outlined here can help you design pricing as a strategic lever for growth—addressing not just revenue, but also product, customer success, and competitive advantage.

Navigating the new pricing environment brought by AI agents? Contact us @ info@ibbaka.com